6 Credit Score Mistakes You Make In Your 20s That Affect Your Entire Future

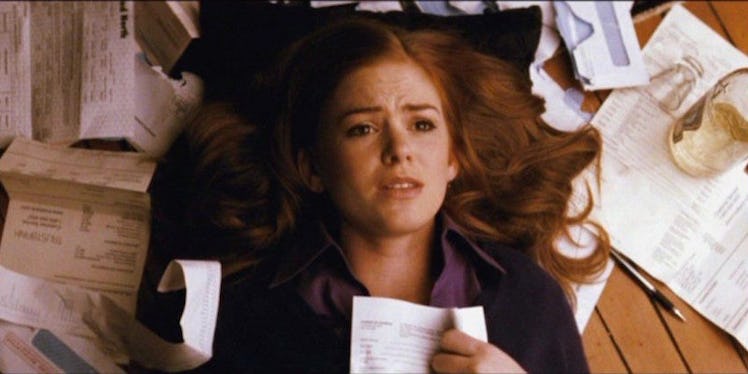

Even though I have my financial act together now, I've massively struggled with credit for most of my adult life.

Here's the DL on that story:

- I developed a nasty shopping addiction in college.

- I graduated in 2009 with over $10k in credit card debt.

- I paid off all that debt while living and working in NYC.

- Then, when I bought and renovated my first home in 2013, I got into another $8k of credit card debt from a runaway renovation.

- I paid off that debt in under 90 days back in 2015.

But through all those credit ups and downs, I wasn't really sure how all of that activity was affecting my credit. Truly, I didn't become educated on my credit score until my late 20s.

Other than co-signing someone else's loans, I've made all the mistakes mentioned in the article below and then some.

So, here's what I recommend you avoid if you want to have stellar credit and the ability to get approved for any type of large loan (home, business, auto, etc.) you may need in the future.

1. Closing Out Old Cards And Opening New Ones

You've likely heard the phrase “use it or lose it,” right? Well, that is the exact opposite of what you should be doing to maintain a healthy credit score.

Since credit scores include factors such as average age of accounts and debt-to-credit ratios, keeping older credit lines and cards that you have paid off open will help your overall credit utilization.

It looks much better to potential lenders to see that you have kept a card a longer time and with a lower balance than to only see the shiny new store credit card you opened to snag a deal on a big-ticket item.

When I paid off all my debt (the first time when I lived in NYC), I got so excited to be debt-free and closed out all but two of my cards. Much to my chagrin, my credit score went down, even though I'd just paid off a mountain of debt.

Pay off your cards, but keep them open so your average "age of credit" is higher. Once you close, the age on those accounts goes away, and you can't get it back.

2. Having High Credit Utilization

Having multiple credit products can look good on your report, but not if they're all maxed out.

Ideal credit utilization should be below 30 percent of your total credit limit for the card, meaning it may be a good idea to whittle down the balances of cards over that 30-percent limit first.

Another way to decrease your utilization, without paying off a big chunk? If you've had the card for a long time, you can try calling your lender to see about a limit increase.

3. Having Too Many Hard Inquiries

If you're applying for every credit card offer you get in the mail, you may be in for a rude awakening when you look at your credit score.

When you apply for credit products, lenders will typically make what's called a "hard inquiry" on your account. Having too many of these inquiries in a 6- or 12-month timeframe can be a major red flag to potential lenders, as it indicates you need money and have a hard time paying down debts.

4. Co-Signing For Loans

I don't recommend mixing money and friendship. Maybe you can with family, but it depends on the situation.

You might feel like you're helping your family member, friend or college roommate out, but co-signing can end up being a big financial misstep for both of you.

When you're co-signing a loan for someone, you're essentially saying that if they aren't able to make the payments, then you will take responsibility and pay.

That's a big commitment, even without considering how it will affect your credit.

5. Making Late Payments

Don't ever get comfortable paying late on a credit product. Even though you may not be charged a late fee right away, your on-time payment percentage will suffer.

A good way to combat forgetting about your payments is to set up reminders or automating your minimum payment for the same time each month.

You can always make additional payments if you want to put more toward a balance, but automating the minimum will keep you from the late payment repercussions.

6. Not Keeping Up With Your Score

When it comes down to it, the best thing you can to do improve your credit score is to be aware of how your credit decisions are impacting it.

If you know your biggest factor is the average age of your accounts, you can be conscientious and avoid opening new credit products.

It is also important to make sure your score is accurately reflecting your credit history. Inaccuracies can be warning signs for fraud or identity theft. (Here's what to do in the event your identity is compromised.)

This article was originally published on the author's personal blog.