Here’s What To Know About When You Should Have Your W-2 Form, So You Can File Taxes

Now that February is right around the corner, you might have some questions about tax season. For starters, you might be wondering: When do you get your W-2 form? Well, the essential tax document should be in your hands sooner than you might think. Despite the recent government shutdown, the Internal Revenue Service (IRS) has predetermined deadlines put into place when it comes to the timeliness of receiving your W-2, either in the mail or a digital version provided by your employer.

The IRS said that, despite the recent government shutdown, they will begin to process tax returns as early as Monday, Jan. 28, according to a tweet posted by the agency. Since the IRS plans to have things moving along soon, you'll probably want to get your taxes filed as soon as possible, especially considering the latest plan to reopen the government only includes funding until Feb. 13, 2019.

With that being said, your W-2 is one of the most important documents to have in order to get your taxes started, since it shows the amount of taxes that were withheld from your paycheck during the previous year, and you use it to file both state and federal taxes, according to TurboTax.

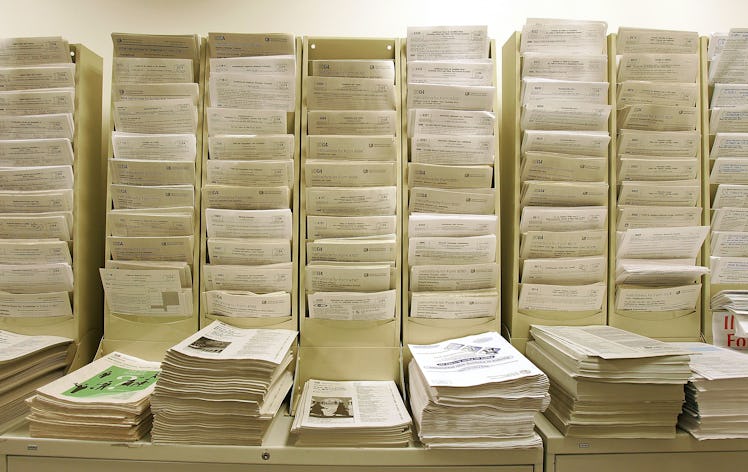

According to the IRS, employers must send employees a copy of his or her W-2 form no later than Thursday, Jan. 31. The forms are usually sent by mail. Some employers may allow you to access the document electronically, as long as you have agreed to receive the form this way. If you haven't gotten your W-2 in the mail just yet, don't worry. There is still plenty of time for it to come. The deadline to file your taxes is Monday, April 15, 2019.

If, for some reason, you do not receive a W-2 from your employer, the IRS has several steps you can follow in order to retrieve the document. First, you should contact your employer. It's possible that the company is behind on mailing out the forms, or maybe it got lost in the mail. If you have not received the form by Friday, Feb. 15, then it's time to call the IRS and let them know.

So, what's all the hubbub about a W-2 form? Well, it's an important document when it comes time to prepare your tax return. The W-2 form contains information about how much federal, state, and other taxes that were withheld from your paychecks over the last year. There's nothing for you to fill out in regards to this form. It's strictly for your employer to complete and mail out to you in a timely manner.

Filing your taxes isn't the most exciting item to mark off your checklist, but it is necessary. For the procrastinators out there, you might be wondering if April 15 is really the absolute last day to pay your taxes. According to financial advice website The Balance, there is a way to give yourself more time to pay your 2018 taxes. All you need for an extra six months to get your payment together is Form 4868: Application for Automatic Extension of Time To File. As long as that form is postmarked on or before April 15, 2019, you can secure yourself a new payment deadline of Oct. 15, 2019, according to H&R Block.

You can't even get your taxes started without a W-2, though, so check your mailbox or ask your employer about a digital copy ASAP, because the form should be made available to you by Jan. 31.