The Republican Senate Passed A Major Tax Reform Bill While You Were Sleeping

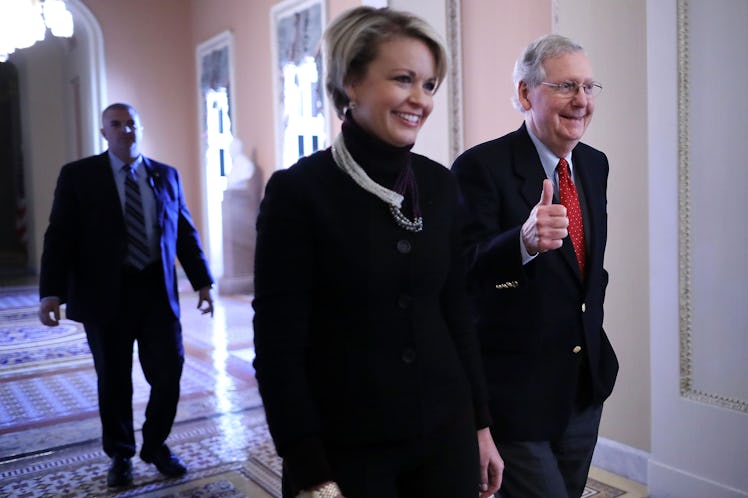

The United States Senate passed a massive tax overhaul in the wee hours of Saturday, Dec. 2. Senate Majority Leader Mitch McConnell had said on Friday, Dec. 1 that the believed he had the votes to pass one of the most massive tax overhauls in nearly 30 years, and he was right. Amidst much debate, the controversial tax bill passed 51-49, with the voting mostly along party lines. So, what will the new tax reform bill do?

In its broadest terms, the tax reform bill would (majorly) overhaul the U.S. tax code, providing large tax cuts for businesses and adding to the national debt. In fact, one of the highest contested aspects of this new tax plan is the cost by which it will raise the national debt. According to The Washington Post, the passage of this bill could add at least $1 trillion to the national debt.

You've probably been hearing a lot about the GOP-backed tax reform bill making its way through the Senate, but after the happenings in the Senate on Friday night, there is more to discover. As it turns out, McConnell didn't really have all of his Republican votes as locked-in as he thought. You'll see that the tax overhaul passed early on Saturday, Dec. 2 has hand-written notes in the margins, and that's because the Senate Republicans were scrambling to amend the document late Friday night in order to insert provisions that would secure the votes of Republicans like Senator Susan Collins of Maine, according to Politico.

Senator Dick Durbin of Illinois posted an image of the hand-written notes inserted into the tax reform bill.

This newly Senate-passed tax overhaul would also aid President Trump and Republicans in their mission of undoing the Affordable Care Act that was passed by President Obama in 2010. According to The Hill, there is a provision in this tax overhaul that would repeal the individual mandate provision in the ACA.

The thinking behind the individual mandate repeal is that the money the government is currently paying out to nearly 13 million individuals who qualify for reduced-cost health insurance would help pay for the debt expected to be incurred with the passage of tax reform. Since there would no longer be a penalty for not having health insurance, those individuals who can't afford it without assistance would likely opt out, and the government would save money by not being on the hook for covering their insurance costs.

According to Buzzfeed, the Congressional Budget Office estimates that this repeal of the mandated coverage provision will hike up health insurance premiums and lead to those 13 million people with reduced-cost health insurance becoming uninsured.

Senator Bob Corker of Tennessee was the lone Republican to vote against the tax overhaul. Corker voted against the tax bill due to his concern of the growing national debt, according to CNN.

Senate Democrats were not pleased with the bill that was pushed through.

The cost of the tax plan (see: the $1 trillion added to the national debt) has been repeatedly explained away by Republicans through what sounds a lot like trickle-down economics. Republicans claimed that when big businesses receive large tax cuts, they use that money to pay their employees more and therefore, boosting the economy. According to The Boston Globe, CEOs have repeatedly responded to that being a false claim simply stating that's not how business works.

The debate surrounding this tax reform bill was heated on Friday. Democrats had harsh words for Republicans due to the fact that Democrats didn't receive the more than 500-page plan (completed with hand-written notes) with enough time to read it before the vote. With a Republican majority, though, the Senate passed the tax reform bill — and now it moves forward to either be passed by The House of Representatives, or it goes to a conference with the House to meld the two bills.

On Saturday morning, Dec. 2, Speaker of the House Paul Ryan made a statement indicating that a conference to reconcile the House and Senate tax bills would be the next course of action. He commended his "Senate colleagues for this historic action," and he said they would "move quickly" to get the final bill to President Trump's desk.

The Republicans overcame a major hurdle by pushing this latest tax reform bill through the Senate, and now we will wait to see what it will look like in tandem with the recently passed House tax reform bill. If they go through seemingly as-is, President Trump could notch what would be his greatest legislative achievement to date.